Sustainability performance at Fund level

Benchmarking based on GRESB enables the Residential Fund to improve sustainability. It provides us with the information we need to report the performance and targets within our assets on a regular basis. We use the GRESB tool to report annually on the Fund’s CSR performance. We can therefore add new objectives or actions following the assessment.

In 2014, the Fund was awarded Green Star status in the annual GRESB assessment. The Fund has retained this status to this day. In 2016, GRESB introduced a new star-rating system, which is based on the GRESB score and its quintile position relative to the GRESB universe. In 2017, the Fund was awarded four-star status (on a scale of 1-5). This was mainly thanks to the improvement of the score on the following subjects: Management, Policy & Disclosure, Risks & Opportunities and Building Certifications. Last year, our overall score increased to 74 from 66 in 2016, but still resulted in a slight decrease of the overall end-chart.

Furthermore, we acquired 163 homes with an energy index of zero.

Sustainability performance at asset level

The Fund uses GPR Building software to measure and assess the overall sustainability of its buildings. The GPR software provides data on the sustainability of residential real estate. The software assesses the building policy, the design, the realisation of the building, plus any renovations if relevant. The GPR software reports on five performance indicators: Energy, Environment, Health, Quality of Use and Future value, and assigns a score for each performance indicator on a scale of 1 to 10. When used on existing buildings, GPR makes it very easy to see any quality improvements following sustainability measures. This in turn makes it very easy to compare various scenarios and the outcome of any measures.

In 2017, 25% of the portfolio (65 properties) received a GPR label with an average score of 6.3.

Another target related to the sustainability at asset level is to achieve a 100% green portfolio (EPC label A, B or C) in 2018.

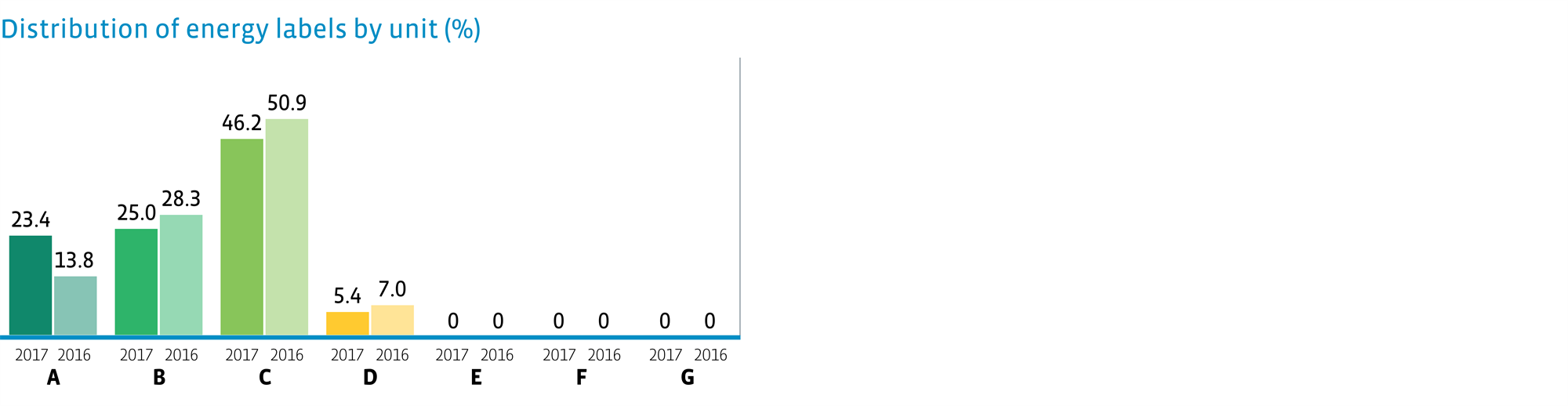

In 2017, the number of assets that qualified for a green energy label increased by 1.3% to a total of 94.6%. We were able to improve the sustainability of 130 homes with a D label, so they now qualify for a green label. The distribution of energy labels in the portfolio is shown below.

Distribution of energy labels in the portfolio