Portfolio composition at year-end 2017:

A total of 16,172 homes (240 properties) across the Netherlands

Total value investment properties of € 4.1 billion

Investments and divestments

Acquisitions

As a result of our active focus on the acquisition of new properties, we reached agreements on a total of 18 properties. More than 60% of the acquisitions in 2017 were in inner-city locations in the Randstad urban conurbation, with the remainder in other core regions:

The assets we acquired in 2017 are described below.

IJburg 1b, Amsterdam

Rental range: € 712 - € 798 per month

Expected delivery date: 2018

The IJburg plot 1B (IvensStudios, www.ivensstudios.nl) project consists of an apartment building with 125 apartments. The Residential Fund has acquired 70 studios with an average floor space of 46 m².

Plot 1B is located on Amsterdam’s Haveneiland-West at the junction of Joris Ivensstraat and Johan van der Keukenstraat near the western end of Haveneiland-West, close to IJburglaan. The building is handy for the fast tram to the Amsterdam city centre. Across the road from Plot 1B is the IJburg shopping centre with a wide range of shops, including two supermarkets. The project also looks out on a small park located behind the shopping centre.

KVL – Oisterwijk

Rental range: € 835 - € 1,205 per month

Expected delivery date: 2020

The 60 apartments in the project are located in the so-called KVL site in Oisterwijk. In its heyday, Koninklijke Verenigde Leder was the largest leather tanning company in Europe. The KVL went into slow decline in the 1970s and the factory finally closed in 2000. In the meantime, 17 years on, BPD is developing a new residential environment on this distinctive site, with (parts of) its industrial heritage reminding us of earlier times. The 60 apartments vary in size between 63 m2 and 138 m², with an average floor space of 83 m².

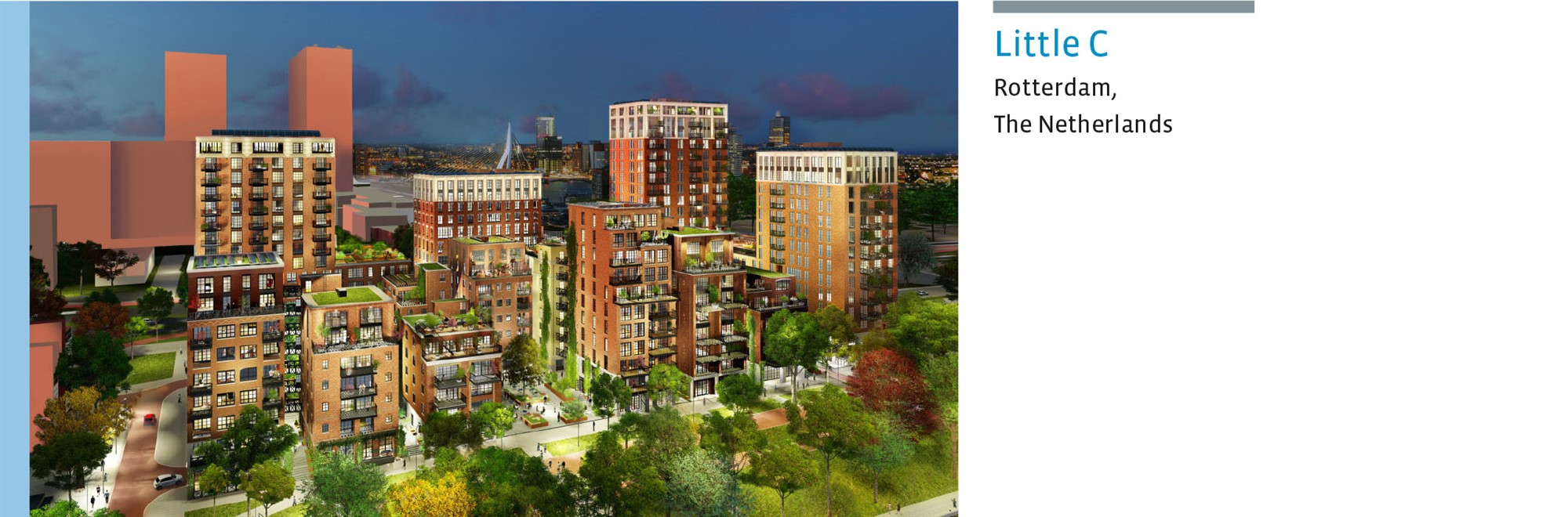

Little C – Rotterdam

Rental range: € 950 - € 1,525 per month

Expected delivery date: 2020 - 2022

The Little C project offers a truly unique residential product. The 209 lofts of between 46 m2 and 156 m² (average of 77 m²) have a higher than average ceiling height (net 2.9 m) and the special cast iron fire escapes and balconies give the buildings a typical New York architectural look. The project also includes the creation of a dynamic inner area for a number of commercial functions, including 8,500 m² of floor space for offices. The Daniël den Hoed house has also signed a contract for 30 short-stay residential units for the families of patients being treated at the nearby Erasmus University Medical Centre.

Elias Beeckman Kazerne – Ede

Rental range: € 820 - € 1,160 per month

Expected delivery date: 2018

The listed Elias Beeckman building in Ede is a former army barracks that until 2010 was occupied by the Ministry of Defence. The barracks were opened in 1939. The Residential Fund has agreed to acquire a total of 64 liberalised sector rental apartments divided across four identical buildings. These apartments will have floor space varying from 76 m2 to 119 m² (average of 84 m²). In addition to these four buildings, the project includes the transformation of two other existing buildings into residential blocks with a total of 32 owner-occupier homes. A residential care complex will be built in the centre of the plan, surrounded by the six residential blocks.

Tudorpark – Hoofddorp

Rental range: € 715 - € 1,375 per month

Expected delivery date: 2019

The Residential Fund has signed a contract for the realisation of 134 homes in the Tudorpark project in Hoofddorp, which is part of the similarly named area development project. This includes 98 houses and 36 apartments. The houses vary from 125 m2 to 138 m², while the apartments have an average floor space of 49.9 m².

The Tudorpark new-build project is located on the southern side of Hoofddorp. It is in the centre of the Randstad urban conurbation, close to Haarlem, Amsterdam, Amstelveen and Schiphol Airport. All the homes are different in the Tudorpark development, which in itself is enough to make this a very special new-build district. The extremely varied range of homes in terms of type, size and look will make Tudorpark an attractive place to live for numerous target groups. The houses in this district are being built in a distinctive English Tudor style, with typical steeply sloping roofs and flat roof tiles, rich ornamentation, varying and staggered façades, design chimney stacks and ornamental masonry.

’t Oog van Nuenen – Nuenen

Rental range: € 1,165 - € 1,320 per month

Delivery date: 2017

The ’t Oog project in Nuenen is part of a much larger residential project recently realised in the centre of Nuenen. The 25 homes, varying in size from 128 m2 to 157 m², are all located on Weverstraat and have south/south-west facing gardens. Behind the homes is a recently realised apartment complex, complete with an underground car park, which also includes the parking spaces for the 25 homes. The nearest supermarket is a five-minute walk away from the homes.

Bellefleur – Culemborg

Rental range: € 895 - € 950 per month

Delivery date: 2017

The Bellefleur project is part of the Parijsch new-build district, which has a total capacity of around 1,100 homes, located to the west of Culemborg. This project is in line with the city of Culemborg’s ambition to expand to 30,000 residents. The Bellefleur section of the project includes 23 family homes with floor space of 122 m², located in a spaciously laid-out neighbourhood with a rural look and feel. The nearest shopping centre is a three-minute bike ride away, while the homes are just a 12-minute bike ride away from the centre of Culemborg. The shopping centre also houses various other amenities, including a sports hall and a health centre.

De Kreek – Oosterhout

Rental range: € 885 - € 1,030 per month

Expected delivery date: 2018

This project involves the construction of 30 family houses built using mixed bricks to the north-west of Oosterhout, looking out over the village of Made. The 30 homes, which are part of a larger project, are located behind the screen of a broad verge with parking spaces, on a through road with excellent transport connections. These homes vary in size from 119 m2 to 138 m². Both sports facilities and the countryside are just a stone’s throw away. The nearest supermarket and the centre of Oosterhout are respectively a four-minute and a 12-minute bike ride away from the most distant house in the complex.

Liverdonk – Helmond

Rental range: € 880 - € 955 per month

Expected delivery date: 2018

The Liverdonk project involves the realisation of 26 houses – varying in size from 104 m2 to 111 m² - to the south-west of Helmond, just 500 metres from the Helmond Brandevoort railway station. The project is a three-minute bike ride from the centre of Brandevoort with a wide range of amenities, including two supermarkets, various other shops and a primary school. The current location of a large primary school, Mondomijn, is the site for the construction of around 300 homes in a new ‘white village’ within Brandevoort. The architectural style is derived from the ‘white village’ Thorn in the province of Central Limburg. The most striking feature of the new neighbourhood in the village of Brandevoort will be the white houses with red and anthracite-blue roofs.

Meijerijlaan – Eindhoven

Rental range: € 950 - € 1,075 per month

Expected delivery date: 2018

For this project, 24 family homes – varying in size from 112m2 to 119m2 – will be built on the site of a former school, complete with a private courtyard with parking facilities. A sport park is located across a through road and a shopping centre with two supermarkets and other amenities is just a six-minute walk away. The station and the city centre are a 10-minute drive from the new residential complex.

De Grassen – Vlijmen

Rental range: € 945 - € 1,125

Expected delivery date: phase 1: 2018, phase 2: 2020

The De Grassen project, to the north-east of Vlijmen, will be realised in several phases. Phase 1 consists of 23 family homes and Phase 2 will comprise 27 family homes (two seperate purchase agreements). The homes will vary in size from 117 m2 to 125 m². The homes are located in a spacious neighbourhood, with lots of green areas, just a few minutes’ walk from the Engelermeer lake and within cycling distance of the city centre of Den Bosch. The homes are three minutes from the centre of Vlijmen with its supermarkets and other amenities. The A59 motorway is just a five-minute drive away by car.

Van de Marckhof – Utrecht

Rental range: € 1,235 - € 1,540

Expected delivery date: 2018

The Utrecht district of Geuzenwijk is the existing urban site for the construction of 46 family homes – varying in size from 122 m2 to 172 m² – built in the form of an urban block. Parking facilities are located in a private and enclosed courtyard. A supermarket and other amenities are a two-minute bike ride away, while Utrecht city centre is just a nine-minute bike ride away. Railway station Utrecht Zuilen is five minutes away.

Kronehoef – Eindhoven

Rental range: € 870 - € 1,045

Expected delivery date: 2018

This project involves the realisation of 54 apartments adjacent to the Woenselse Markt shopping area north of Eindhoven central station, with enclosed, ground-level parking facilities (parking standard 1 to 1). The area plan development started in 2017, while these homes are currently in the initial design phase. The homes will be just a five-minute bike ride from Eindhoven central station. The adjacent Woenselse Markt, which the south-facing homes overlook, provides a wide range of retail and other amenities. The western section of the district is very much on the rise, thanks to large-scale demolition/new-build and transformation.

De Lunet – Breda

Rental range: € 840 - € 935

Expected delivery date: 2019

A former shopping centre on the Tramsingel in Breda, which is within walking distance of the city centre, is the location of a new-build project with around 175 apartments. The Residential Fund will acquire at least 45 of these apartments – varying in size from 50 m2 to 100 m² - for rental in the liberalised rental sector, complete with parking spaces (1 on 1) in an enclosed ground-level parking facility.

Welgelegen Park – Apeldoorn

Rental range: € 770 - € 990

Expected delivery date: 2018

The Welgelegen Park project in Apeldoorn consists of an apartment building with 31 liberalised sector rental apartments varying in size from 67 m2 to 93 m², 23 family houses varying in size from 102 m2 to 126 m² and a minimum of 54 private parking spaces at ground level.

Welgelegen is a district on the eastern side of the Apeldoorn canal. The centre of Apeldoorn is located on the other side of the canal. The neighbourhood is close to a wide range of amenities, shops, the local Dutch Rail train station and access roads.

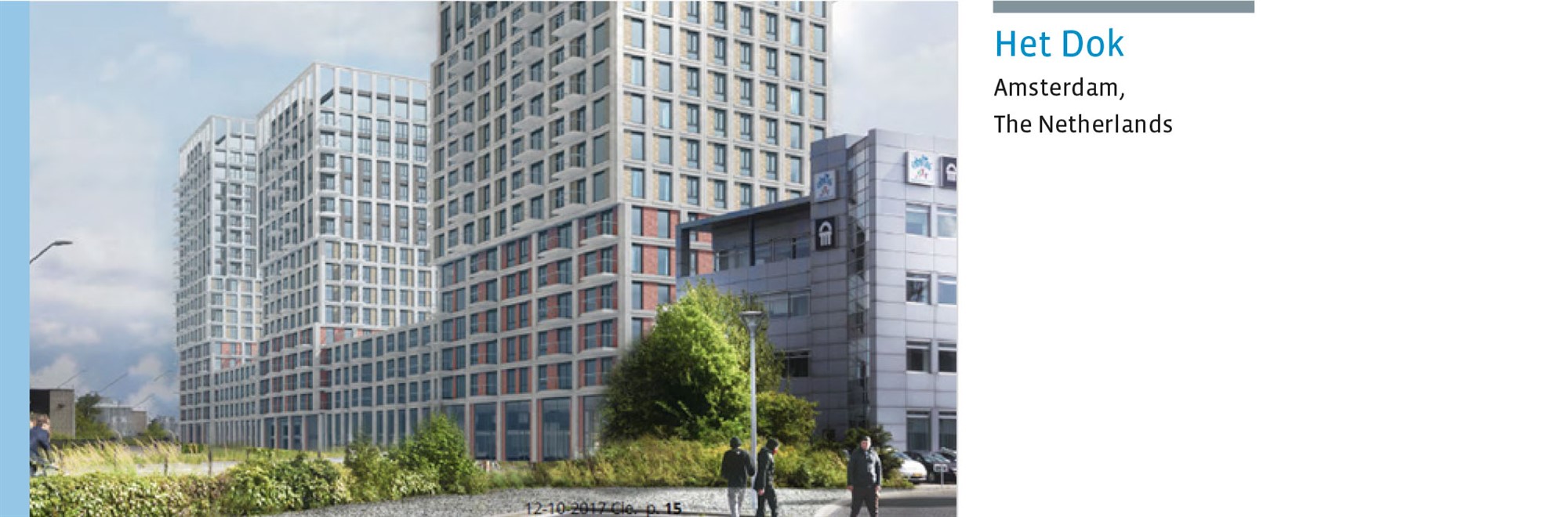

Het Dok – Amsterdam

Rental range: € 710 - € 1,965

Expected delivery date: 2020

Het Dok project on the NDSM docklands site consists of 449 liberalised sector rental apartments (304 of which were acquired in 2016), 100 parking spaces and 2,270 m² of commercial space. The apartments vary in size from 50 m2 to 106 m².

Het Dok project is located in the NDSM docklands development area. The area has a marked industrial look and feel with a wide range of functions, and is currently being transformed into an urban residential, work and leisure district. The total redevelopment of the NDSM docklands area covers around 440,000 m² of mixed-use real estate, including residential, work, retail, food & beverage, culture, leisure, social amenities and parking facilities.

Rijswijk – Buiten

Rental range: € 875 - € 1,145

Expected delivery date: 2020

Rijswijk Buiten is the new residential area located on the south-west side of Rijswijk. The Sion section of the project includes the development of 38 family houses varying in size from 99 m2 to 116 m2 and 59 apartments varying in size from 59 m2 to 89 m2 for the Residential Fund. Sustainability is one of the main ambitions of the Rijswijk Buiten development. For instance, all the homes realised to date have been built as EPC=0 (energy neutral) homes. The neighbourhood has been designed to appeal to a wide range of target groups. The area includes homes for families, (starter) two-income households and retired residents. The Residential Fund already owns 43 houses in the neighbourhood.

Investments

In 2017 the following properties were added to the portfolio.

Properties added to the portfolio

Property | City | No. of residential units |

Zijdebalen I | Utrecht | 104 |

Zijdebalen II | Utrecht | 73 |

Vredenburgplein | Utrecht | 49 |

Blok 61 (Strijp S) | Eindhoven | 96 |

Noorderstreek | Tilburg | 76 |

De Rokade (Loolaan) | Apeldoorn | 39 |

Nautique Living | Amsterdam | 403 |

t Oog van Nuenen | Nuenen | 25 |

Mijn Paleis | Den Bosch | 224 |

Landgoed Alverna | Aerdenhout | 36 |

Bellefleur | Culemborg | 23 |

Divestments

Following our annual hold-sell analysis, Bouwinvest decided to sell the properties below.

The following aspects play an important role in de decision to sell:

In 2017, the Fund sold the following properties:

Properties sold

Property | City | No. of residential units |

Residence Maasweerd | Venlo | 47 |

Schepelweyen | Valkenswaard | 45 |

De Horden | Wijk bij Duurstede | 76 |

De Heeze II | Apeldoorn | 10 |

De Heeze III | Apeldoorn | 10 |

De Heeze IV | Apeldoorn | 10 |

A dwinger | Groningen | 24 |

Haags Modehuis | The Hague | 74 |

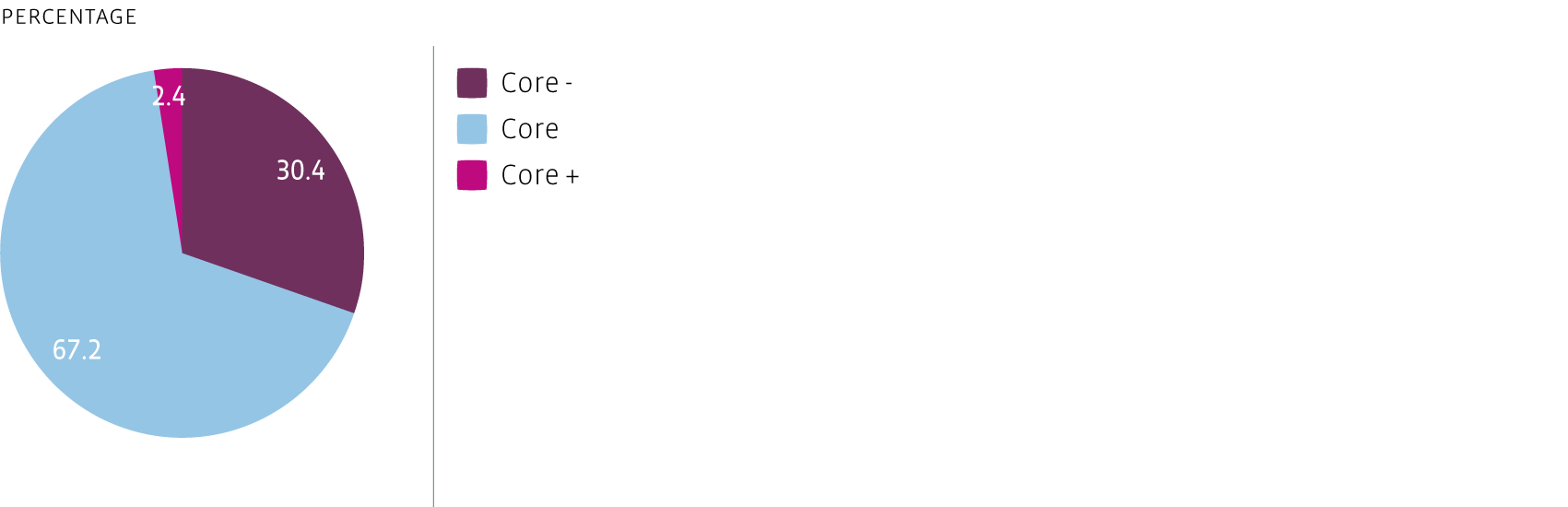

Risk-return profile

In 2017, active asset management of the current portfolio and acquisitions ensured further optimisation of the Fund’s risk-return profile. The Residential Fund has a well-balanced risk profile, with the focus on low-risk assets in the Fund’s core regions.

Portfolio composition by risk category based on market value

Portfolio diversification

At year-end 2017, the Fund’s total portfolio consisted of a total of 240 properties containing 16,172 homes across the Netherlands.

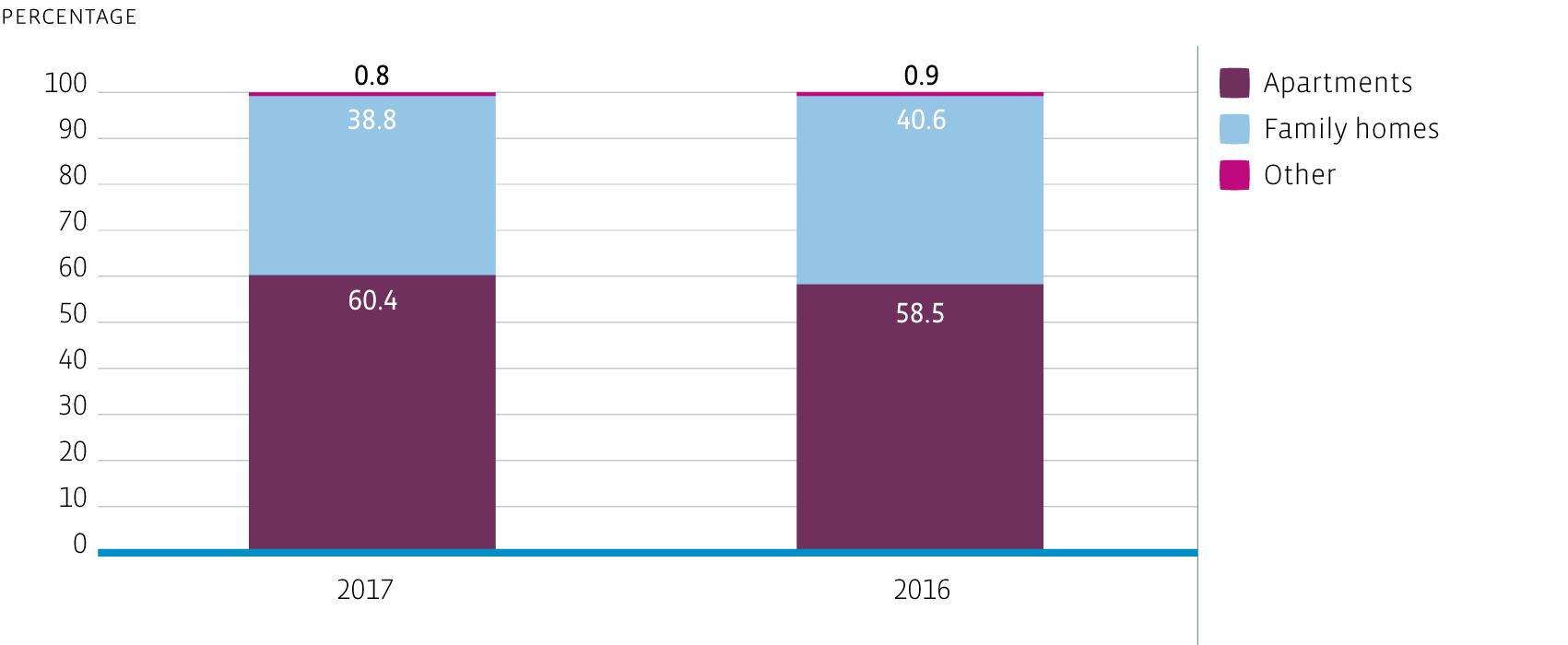

Type of property

The Fund aims for a balanced mix of family homes and apartments, catering for the needs of couples, single occupiers and families alike. In 2017, the Fund bought and sold both family homes and apartments. Compared with 2016, the proportion of apartments in the total portfolio had increased at year-end 2017 (2017: 60.4%; 2016: 55.4%). Because we focus on inner-city areas, the proportion of apartments will continue to grow for the foreseeable future.

Portfolio composition by type of property based on market value

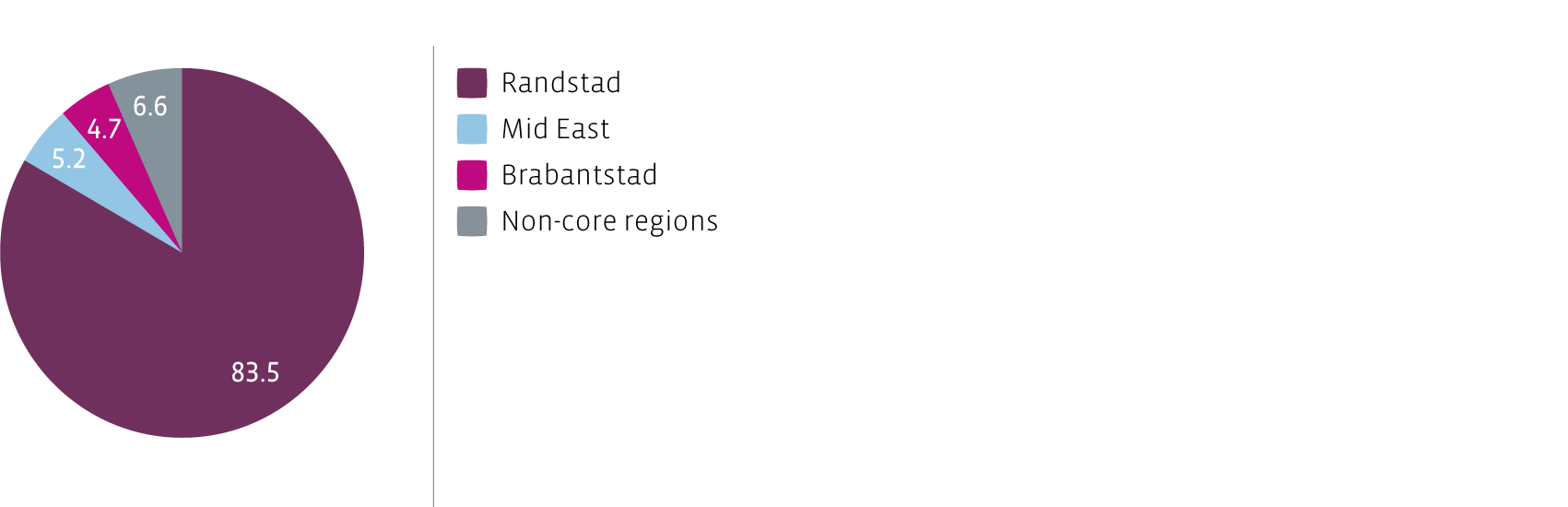

Core regions

The Fund aims to achieve a balanced diversification, with a strong focus on core regions with a positive economic and demographic outlook. The target is to have at least 80% of the total value of the portfolio concentrated in residential real estate in these core regions.

Due to revaluations, together with acquisitions and divestments in 2017, over 93% of the portfolio value was located in these core regions, with by far the greatest part (83.5%) located in the core region of the Randstad urban conurbation.

Portfolio composition by core region based on market value

The Fund constantly refines its long-term regional focus. This involves anticipating and responding to long-term trends that may affect the value of the portfolio, such as the growth in the number of households, the ageing population and steadily increasing urbanisation. The Fund’s core regions include the Randstad conurbation (Amsterdam, Rotterdam, The Hague and Utrecht), the Brabantstad conurbation (Breda, Eindhoven, Helmond, Den Bosch and Tilburg) and the eastern region (Arnhem, Apeldoorn, Nijmegen and Zwolle). These regions are expected to see the greatest population growth and largest increase in the number of households.

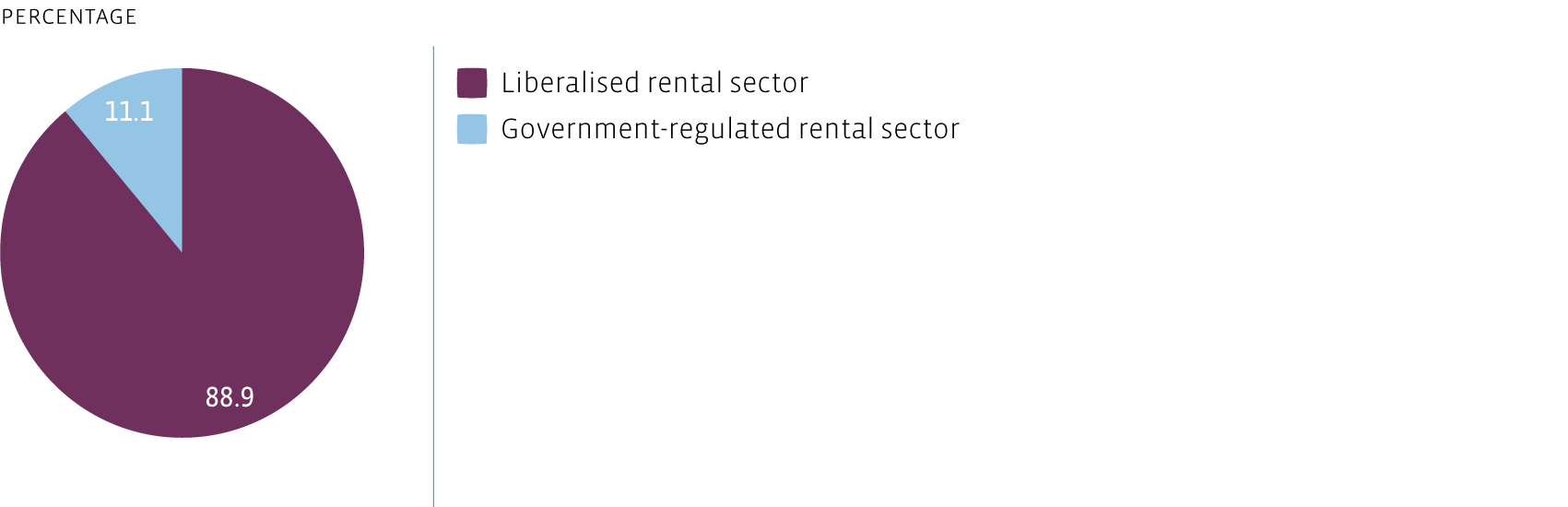

Rental segments

As a result of active asset management, investments and divestments, the percentage of liberalised rental homes in the portfolio increased very slightly to 88.9% in 2017, from 88.7% in 2016.

Portfolio composition by type of rent based on rental contract

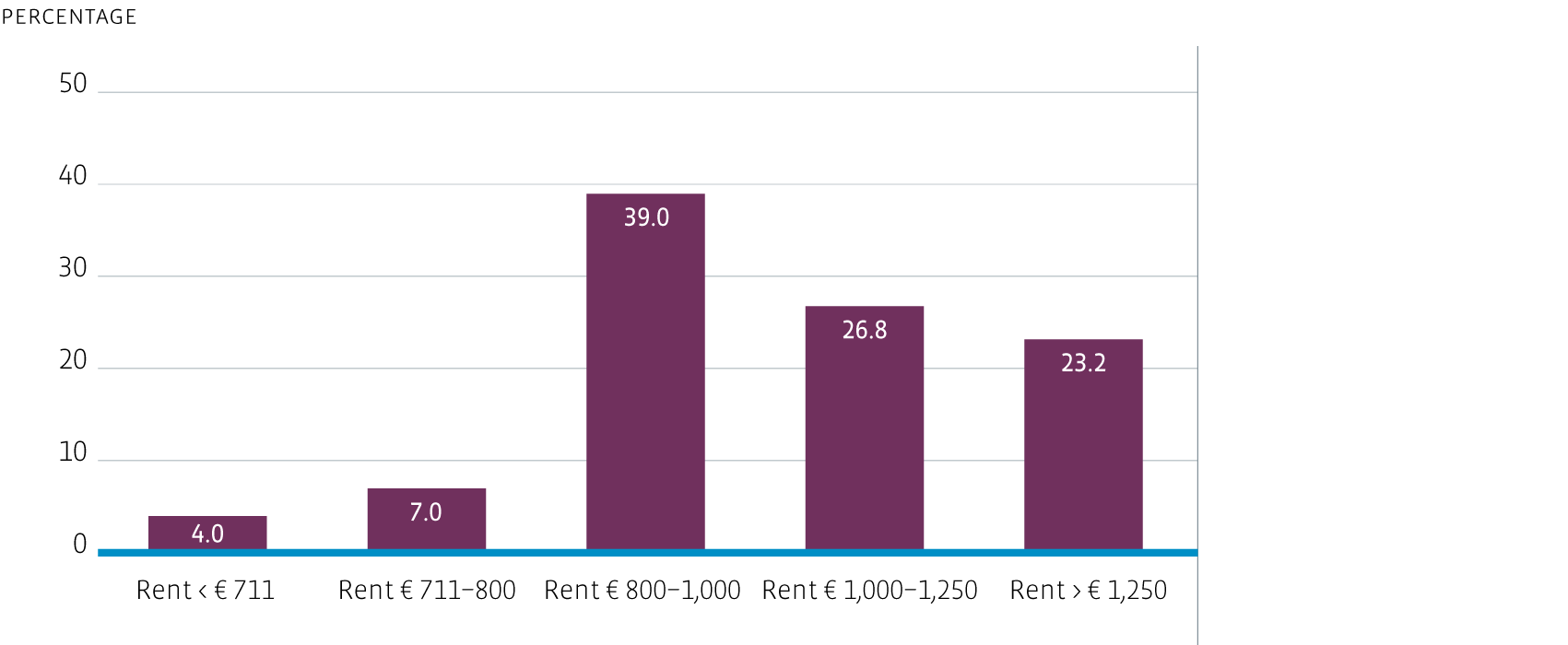

Price level

With an average monthly rent of € 1,020, the Fund's focus continues to be on the mid-rental segment. Approximately 75% of the portfolio has a monthly rent of between € 711 and € 1,250. With the acquisition of 1,156 homes in 2017, mostly in the mid-rental segment, the Fund is well represented in a segment that is in high demand due to the current economic conditions. Individuals, couples and families who do not qualify for government-regulated rental housing are still finding it difficult to buy due to the sharp rise in house prices and the lack of affordable supply, especially in the Randstad. In addition, the rental market gives customers greater flexibility, which is becoming more important as people switch jobs more frequently than ever before. The Residential Fund’s continuing focus on the mid-rental segment has given it a solid portfolio of prime properties perfect for this target group.

Portfolio composition by price level based on rental income

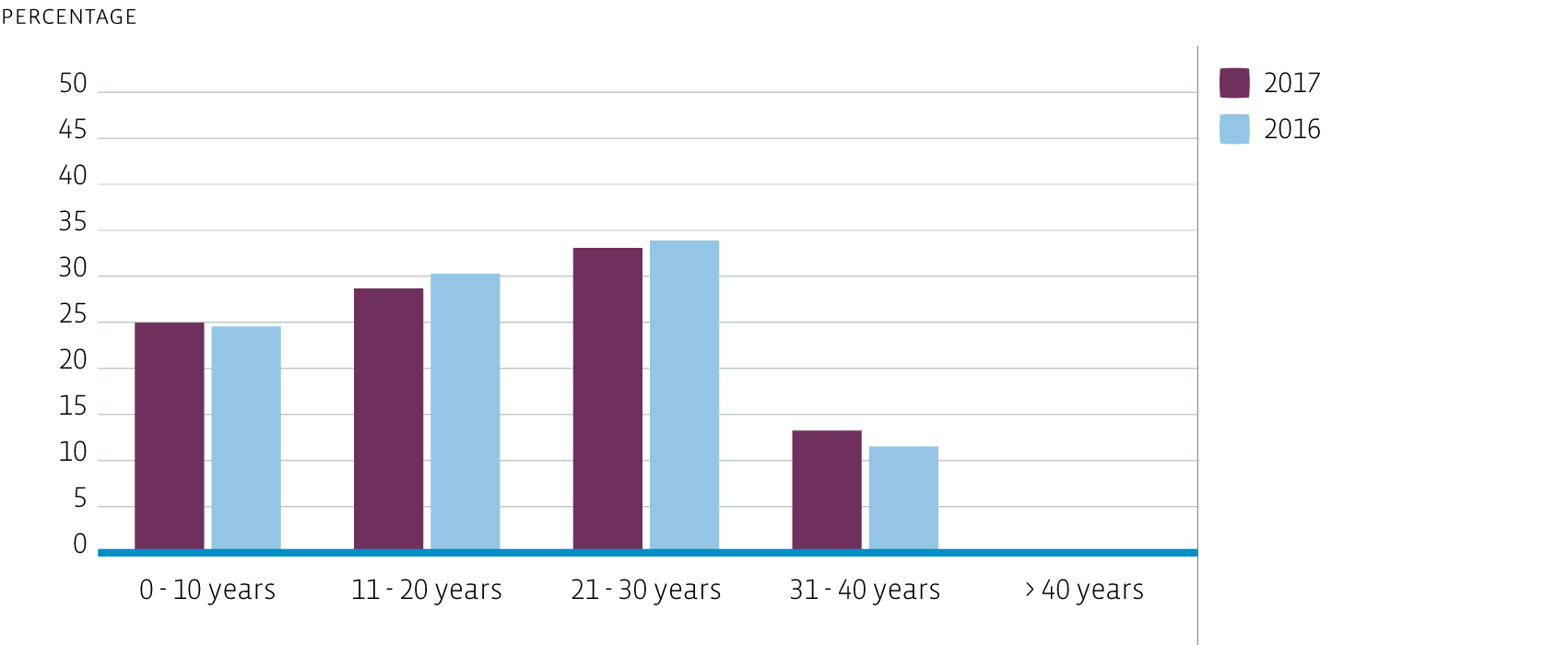

Age

As a result of the refreshment of our portfolio in 2017, the weighted average age of the portfolio decreased slightly compared to year-end 2016 (17.9 years in 2017 versus 18.0 years in 2016).

Although we have increased our disposal target for the coming years, the weighted average age of the portfolio is expected to increase in the future, due to the ageing of the total portfolio. Older assets that still generate good returns are held in the portfolio and are kept up-to-date through refurbishments, including new bathrooms and/or kitchens, together with measures designed to increase energy efficiency and cut carbon emissions.

Portfolio composition by age as a percentage of market value

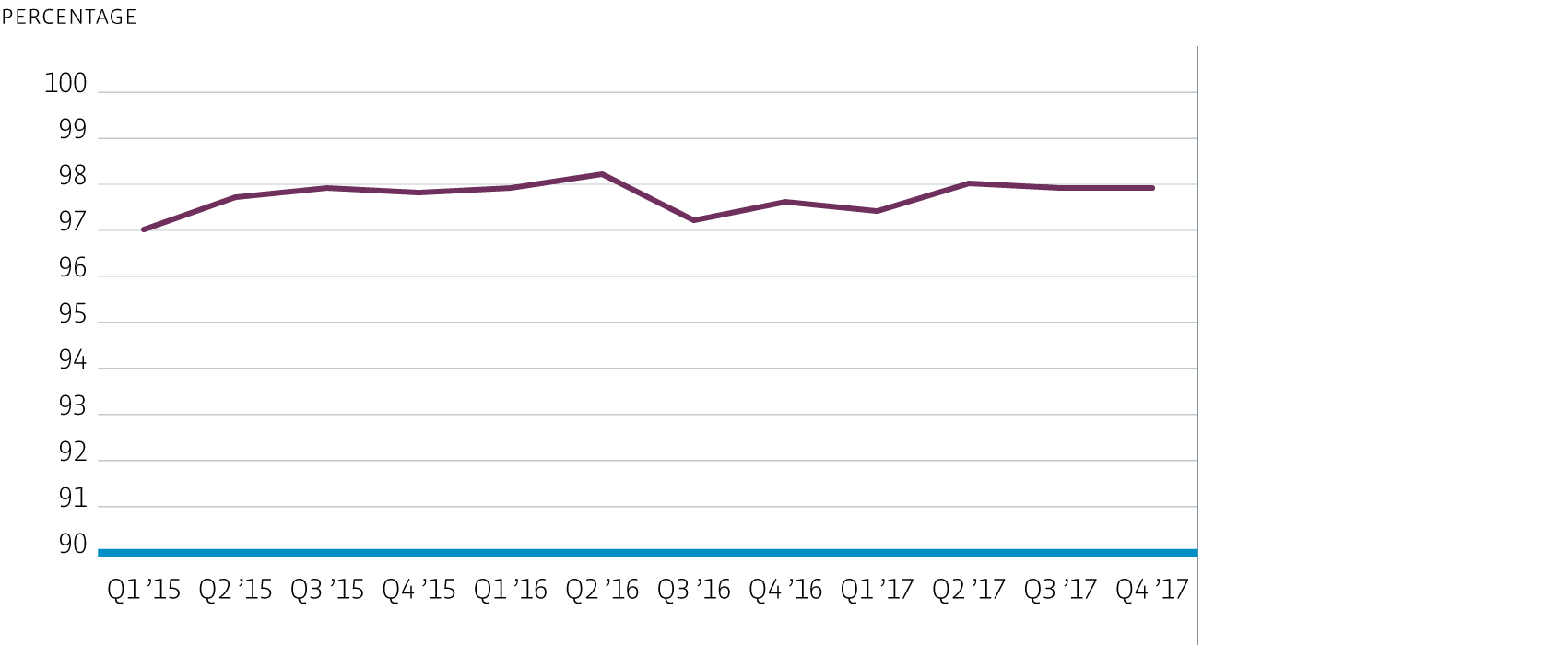

Financial occupancy

A key element of Bouwinvest’s active asset management is the aim to realise an optimal fit to tenants’ needs by engaging with the evolving housing desires identified by our marketing and asset management teams. Bouwinvest has therefore divided the tenant population of the portfolio into six specific customer segments. These segments differ significantly and are based on lifestyle, housing ambition and housing preferences.

We are convinced that this marketing approach combined with high-quality housing products at the best locations, is the main reason that almost all new properties added to the portfolio were fully let before completion and the overall financial occupancy rate is a very satisfying 97.8%.

Financial occupancy rate