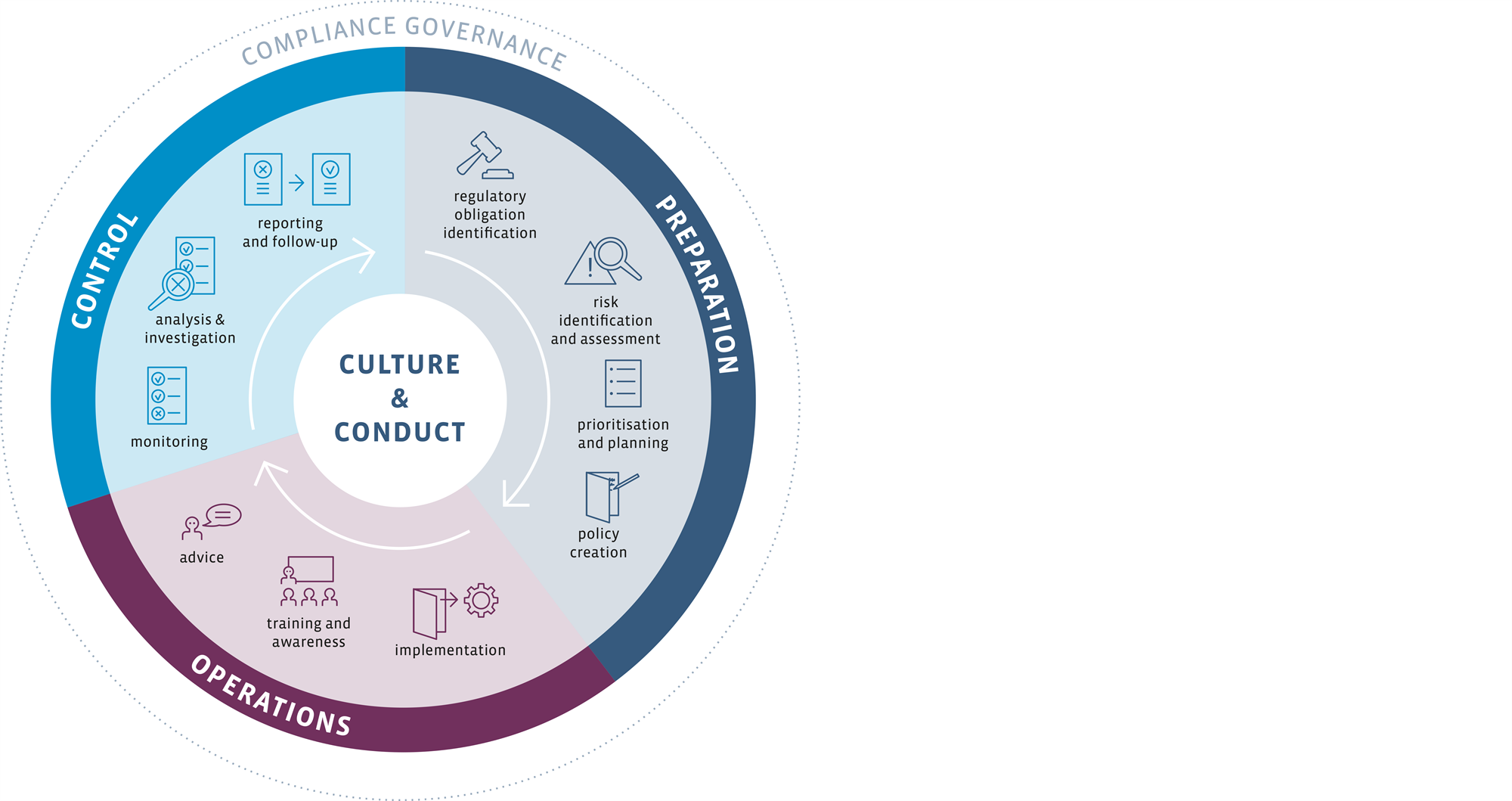

Bouwinvest has an independent compliance function that identifies, assesses and monitors the company’s compliance risks and advises and reports on same. For the planning, execution and reporting of all compliance activities, Compliance uses the Bouwinvest Compliance Cycle. This cycle contains groups of activities. The first group of activities focuses on the identification and interpretation of existing and new legislation relevant to Bouwinvest and its stakeholders and to determine its impact. Bouwinvest subsequently identifies and assigns scores to the relevant compliance risks. On the basis of same, we set priorities and translate the (amended) legislation and identified risks into policies, which we then implement.

Compliance designs the processes, procedures and/or controls needed to execute the updated and new policies. During implementation and on an ongoing basis, Compliance devotes a great deal of effort to creating awareness and providing advice (both during the introduction of new policies and on a continuous basis) on relevant compliance risks and how to deal with them, which has helped us to reduce the number of incidents.

Bouwinvest’s compliance function supervises and monitors the effectiveness of the controls and initiates specific investigations when this is necessitated by incidents or findings from regular monitoring activities. In regular compliance reports, Compliance reports on any areas of potential improvement, as well as on any investigations initiated.

Compliance Cycle

Key priorities

One of the key priorities of Bouwinvest’s integrity and compliance function is creating and increasing company-wide awareness of compliance risks, how employees can mitigate or control these risks and what is expected from them on this front. Increasing awareness was once again a major focus in 2017, and Compliance ran a number of training courses and sessions on legislative changes and updated procedures. Bouwinvest also organises a mandatory annual integrity workshop for all employees.

The compliance risk environment is very dynamic and the legislation governing asset managers changes constantly. In 2017, the Compliance officer worked on the updating of a number of risk-related internal rules and regulations. These included the rules governing the screening of business partners, as well as rules related to sanctions, privacy legislation and related matters. Last year, Compliance also updated the remaining internal compliance policies. Bouwinvest closely monitors relevant legislation and regulations and will continue to adapt and update its own internal compliance regulations to new or amended legislation.

Code of Conduct

Bouwinvest has a Code of Conduct that applies to all its employees. This code includes rules with respect to ethical conduct, conflicts of interest, compliance with laws and (internal and external) regulations, CSR (Corporate Social Responsibility), health and safety and requirements for our business partners. The Code also includes specific regulations for the Board of Directors and the Supervisory Board with respect to conflicts of interest and investments.

Bouwinvest has a whistleblower scheme in place with guidelines for reporting and investigating unethical behaviour. All Bouwinvest employees receive code of conduct training.

Conflicts of Interest policy

Bouwinvest has also drawn up a Conflicts of Interest policy, with the aim of ensuring that no material conflicts of interest occur that could inflict damage on our clients, our funds, or our management organisation. The policy also describes how Bouwinvest should act with respect to the allocation of different investment opportunities over the respective funds and clients. The policy is intended to supplement but not replace any applicable Dutch laws governing conflicts of interest.