Bouwinvest recognises the importance of a solid framework for risk management, aimed at identifying and mitigating risks, which in turn makes it possible for the company to achieve its goals more effectively. Bouwinvest has chosen the globally recognised COSO framework as the model for its risk management. This model goes beyond internal controls and covers the entire internal management system and is known as COSO II or the Enterprise Risk Management Framework (ERMF). Bouwinvest used this framework to draw up its own reporting and monitoring framework.

Compliance, risk management, control and internal audit have all been designed in line with this model. This model takes an integrated approach to compliance and risk management, with policies designed in such a way that they meet the requirements of regulatory bodies, public opinion and shareholders, while making the execution of supervisory functions as focused, efficient and cost effective as possible.

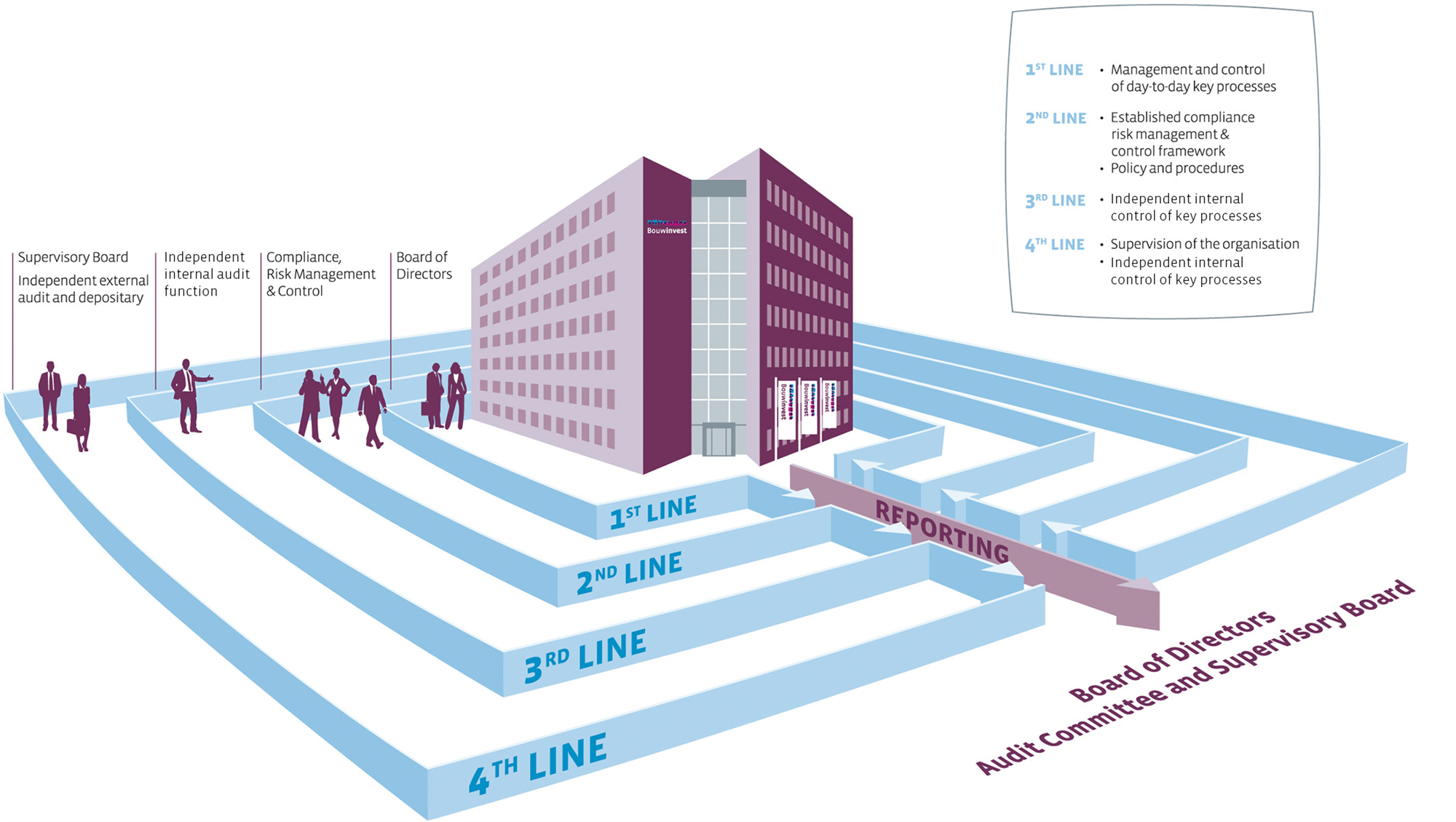

The four Lines of Defence are shown in the figure below:

Alternative Investment Fund Managers Directive (AIFMD)

In early 2014, Bouwinvest was one of the first parties in the Netherlands to obtain an AFM licence as required by the AIFMD. This licence allows Bouwinvest to manage funds that are open for other institutional investors besides bpfBOUW. The AIFMD specifies certain transparency and integrity-related requirements for Alternative Investment Funds (AIFs). In 2017, Bouwinvest discovered no major issues in the context of the AIFMD.

Dutch Financial Supervision Act

Bouwinvest has obtained a licence within the meaning of Article 2:65 of the Dutch Financial Supervision Act (Wet op het financieel toezicht). Bouwinvest is therefore subject to the supervision of the Dutch Financial Markets Authority (AFM) and the Dutch Central Bank (DNB).