Economy & politics

Positive outlook Dutch economy

In the course of 2017, the Dutch economy gained additional positive momentum. GDP growth was largely driven by strong export figures, private investments and increased household spending. Housing market-related sectors have flourished in recent years, largely thanks to the very strong rebound in the housing market following the 2008 financial crisis.

Real GDP growth is expected to be around 3.2% and 3.1% in 2017 and 2018 respectively, according to forecasts from the Netherlands Bureau for Economic Policy Analysis (CPB). This is expected to be followed by lower growth rates in the subsequent two years (1.9% in 2019 and 1.5% in 2020). Unemployment has declined steadily to the current level of about 4.5% and is expected to decline further in the years ahead. Job growth is forecast to be positive in a whole range of sectors. Inflation is expected to increase somewhat, to a maximum level of about 2%, but will remain low from a historical perspective. Persistent low inflation is expected to boost consumer spending by an additional 1.5 - 2% annually. All in all, the economic outlook for the Netherlands is solid for the next few years, despite some international political uncertainty.

Brexit and ECB's monetary policy

The overall impact of the Brexit is as yet difficult to assess. So far, the direct consequences seem to be positive for the Netherlands, as we have already seen a string of announcements by international companies and institutions planning to move at least some of their offices to the Netherlands, with the relocation of the European Medicines Agency from London to Amsterdam being the most noteworthy. This will have a direct impact on the office real estate market, and possibly the residential and retail markets.

With respect to the European Central Bank’s monetary easing policy, the current programme to purchase a total amount of € 60-80 billion of public and private debt on a monthly basis in order to achieve an inflation level of 2%, was tapered off in early 2018, when the ECB cut its monthly purchases to € 30 billion.

New coalition introduces policies that could harm institutional investors

Following the Dutch general election in March 2017, a four-party coalition government, consisting of the Liberal VVD, the centrist D66, the Christian Democrat CDA and the Christian conservative CU party, was formed in October. The new coalition will have a majority of just one in the highly fragmented 13-party Dutch parliament.

In the coalition agreement, the newly-formed government announced that fiscal investment institutions (Dutch: ‘FBI’) will no longer be allowed to invest directly in real estate. The change is supposed to come into effect from the financial year 2020 onwards. Bouwinvest, together with other institutional investors, is currently trying to persuade the government not to implement this regulation. Additionally, Bouwinvest is investigating the potential consequences of such a change in fiscal legislation for the funds it manages and is assessing alternative structures to minimise the negative fiscal impact on investors in these funds.

Political impact on the retail market

'The retail agenda' was launched in 2015 and is a widely supported plan and think tank, involving a cooperative effort from the national government, local authorities, investors and retailers. All parties agree on the need for an in-depth discussion on new retail developments in an already saturated market. With the aim of rejuvenating some ailing city centres, the agenda also focuses on redevelopment issues. However, the interests of the various stakeholders vary widely and the Association of Institutional Property Investors in The Netherlands (IVBN) decided in December 2017 to withdraw its direct support, as the other parties involved were not open to further dialogue regarding more flexible rental legislation.

Demographics

Continuing population and household growth

On a national level, both the total population and the number of households are expected to continue to grow in the coming decades. The total population is set to increase by over 700,000 in the 10 years leading up to 2025. In this period, the number of households is projected to rise by almost 600,000 to 8.3 million. This demographic growth, however, will be very much concentrated in the 20 largest municipalities in the Netherlands, especially the main cities of the Randstad region. While household growth in the four largest cities of the Randstad conurbation will be a cumulative 11% in the years to 2025, the figure for the country as a whole is expected to be 7.7%.

Urbanisation and ageing major drivers

The growth in the number of households will be largely driven by the growth in one and two-person households, which in turn will be dominated by the growing number of elderly households. The number of people older than 75 years is expected to double over the next 25 years. As a result of this trend, the working population in the Netherlands will show virtually no growth over the coming years. However, the major Dutch cities will not be affected by this demographic trend, as the healthy and growing availability of employment opportunities will lead to a steady influx of (young) working people, especially in the cities of the Randstad region.

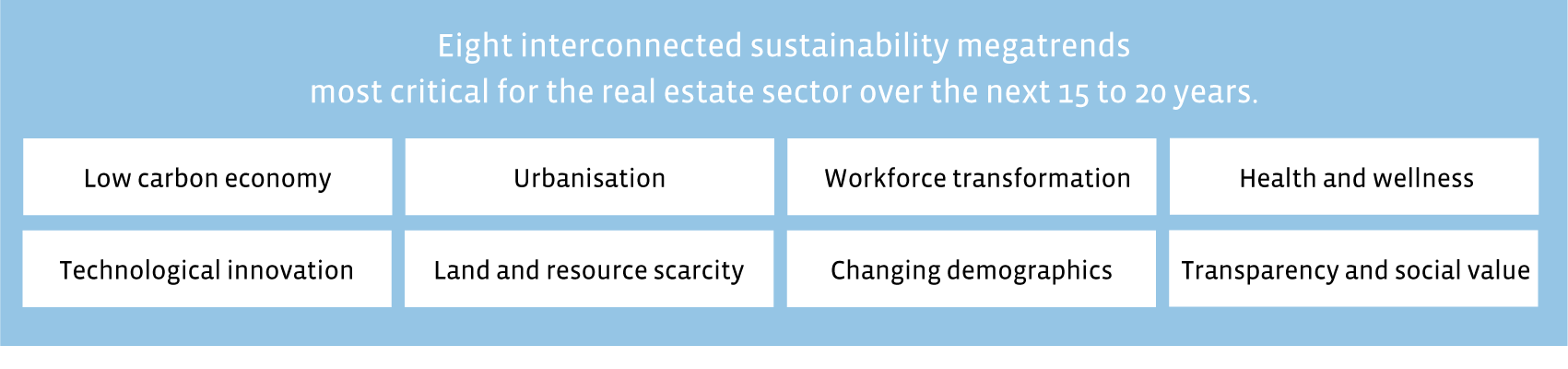

Demographic shifts in population, urbanisation and ageing are trends that will continue to have an impact on living, shopping, working, mobility and leisure. These trends make it even more important to align the products in the real estate investment market with the future demands of both users and investors.

Capital market

Strong increase in investment volumes

Given the low interest rate environment and the yield spread offered by real estate, investors’ capital inflow into real estate markets remains strong. In 2017, around € 21.0 billion was invested in the Dutch real estate market, significantly more than the € 14.1 billion invested in the previous year. This increase in investment volume was driven by both domestic and international investors, although the market share of the latter group increased. A year-end breakdown is not available yet, but midway through the year international players had accounted for 67% of total investments, compared to 60% for the full year 2016. Strategies among investors differ. Domestic institutional investors largely prefer core fund investments, while US investors target more opportunistic funds (even without seed assets) and Asian investors focus primarily on large single asset deals. European investors tend to concentrate on existing assets, preferably combined in a portfolio, which enables them to achieve acquisition targets more quickly.

Positive expectations

We expect investors’ appetite to remain high for real estate investments, despite the expected rise in interest rates. This is due to the fact that real estate continues to prove its value in terms of adding diversification to investment portfolios and the attractive yield and total return it offers compared to interest rates and other asset classes. The highly transparent Dutch property market will remain a major destination for international investors eyeing European property markets.

Investment market

Investment volumes up, supply of core product limited

Despite a shortage of new-build core assets, retail investments increased further in 2017, especially due to a number of large portfolios being transferred.

Preliminary data for 2017 indicates that the retail sector accounted for an investment volume of close to € 5 billion, or around a quarter of total real estate investments. This is a further increase compared to the € 2.2 billion invested in retail property in the previous year.

In line with the increase in investor interest, gross prime yields in the largest cities compressed over the course of last year and ranges from 3.0% to 4.0% in the largest cities in the Netherlands. Drawback of these low yield levels is the increasing difficulty in purchasing A-quality retail meeting our financial requirements. The spread between prime and secondary locations across and within cities remains substantial. High-performing and good sized ancillary centres can offer attractive returns, as the occupier and investment markets gain traction.

Investor appetite for retail property might broaden further

Following the increase in investment volumes, we expect investor interest for the retail market to remain high, resulting in further downward pressure on prime yields. Investor interest in secondary properties is gaining traction, but contraction of secondary yields is not yet expected, which could possibly lead to a further increase in yield gap between prime and secondary assets.

Occupiers market

Retail landscape gaining positieve momentum, but still facing challenges

Once again in 2017, a number of retailers proved unable to keep pace with changing consumer preferences. Chains like the Phone House, Doniger Fashion Group (Gaastra, McGregor) and Witteveen were forced to file for bankruptcy. On the other hand, credit insurer Atradius expects the number of bankruptcies in retail to decline after 2017, as the growth in consumer spending is likely to support the remaining retailers. International retailers profiting from economies of scale, such as Primark, Zara and Hudson’s Bay, continued to expand strongly in the top 20 cities of the Netherlands. Online shops (Coolblue, Fietsenwinkel.nl en FonQ) are switching to omni-channel strategies by renting physical shops, sometimes in very high-profile locations.

Polarisation continues in stabilising market

The current structure of the Dutch retail market is a result of strict governmental planning policies and is hierarchical in nature, with a clear distinction between various types of property and location, such as inner city shopping centres, urban district shopping centres, district shopping centres, neighbourhood shopping centres and peripheral retail locations. Most recent data show declining vacancy rates, increasing take-up and stable rents on a national level. However, the polarisation seen in recent years is still continuing at both regional and retail segment levels. Regions with a strong demographic and economic growth outlook offer a far stronger basis than regions suffering from demographic and economic contraction.

Sustainability and climate change

Global goals

The Paris Climate Agreement (COP21), the United Nations 2030 agenda for sustainable development and the Dutch Energy Agreement all marked the start of the race to curb global greenhouse gas (GHG) emissions in order to keep the global temperature rise below 2 degrees Celsius by 2050. At that point, all major business sectors should be operating in what will essentially be a zero carbon emission environment.

The built environment consumes around 40% of the world’s energy and accounts for up to 30% of the world’s annual GHG emissions. Additionally, the building industry is a large user of raw materials. It is therefore essential that the companies and people who manage global real estate assets play a significant role in finding solutions. This means that the building and construction sector has to move towards a completely zero carbon built environment by 2050. The Energy Performance of Buildings Directive (EPBD) applicable to European countries requires all new buildings to be near zero-energy by the end of 2020.

Sustainability and the retail market

With regard to the retail market, this will only increase the focus on sustainability. This is also in line with demand: both occupiers and investors are increasingly focusing on this aspect. Firstly, due to the recognition that occupiers and owners themselves are also judged on their actual levels of sustainability; secondly, as the level of sustainability of a retail asset is also an indication of the quality of the asset; and finally, due to the fact that sustainability has become mainstream.

Technology and innovation

Property and technology

Proptech is an overarching term used for technological innovations in the property sector. Innovative proptech concepts include the creation of digital platforms for improved information and knowledge exchange, the use of virtual reality or augmented reality in the design and marketing of properties, the addition of sensors to buildings to obtain more knowledge on their usage and performance, advanced (big) data analytics for property selection, as well as the possible use of blockchain technology for smart rental contracts to speed up and simplify processes and cut overheads.

New construction process and materials

New materials are opening up possibilities and helping to increase sustainability. Overall, the trend is towards the re-use of building materials when redeveloping and constructing buildings in line with the circular economy concept. Additionally, we are seeing the rise of new building methods, sometimes on-site, like 3D printing, but more often off-site. Drones can be used for inspection purposes, while robots can pour concrete and lay bricks.

Technology improves shopping experience

Technology is playing an increasingly important role in the retail market. Retailers are attracting consumers with in-store technology, using it to implement their omni-channel strategies, improve shopping experience and create consumer loyalty. Mobile devices create a whole range of opportunities, ranging from personalising products to guiding consumers through shopping centres. Continuous monitoring of passers-by gives investors and retailers vital information, but can also be controversial in terms of violating the privacy of consumers.