Portfolio characteristics

€ 4.6 billion in Dutch residential properties (240 properties, 16,172 dwellings) at year-end 2017

Focus on the Randstad, Brabantstad and Mid East conurbations and inner-city areas

Focus on the liberalised rental sector

Continuously high occupancy rate

High percentage of green energy labels (A, B or C label)

Four-star GRESB Rating

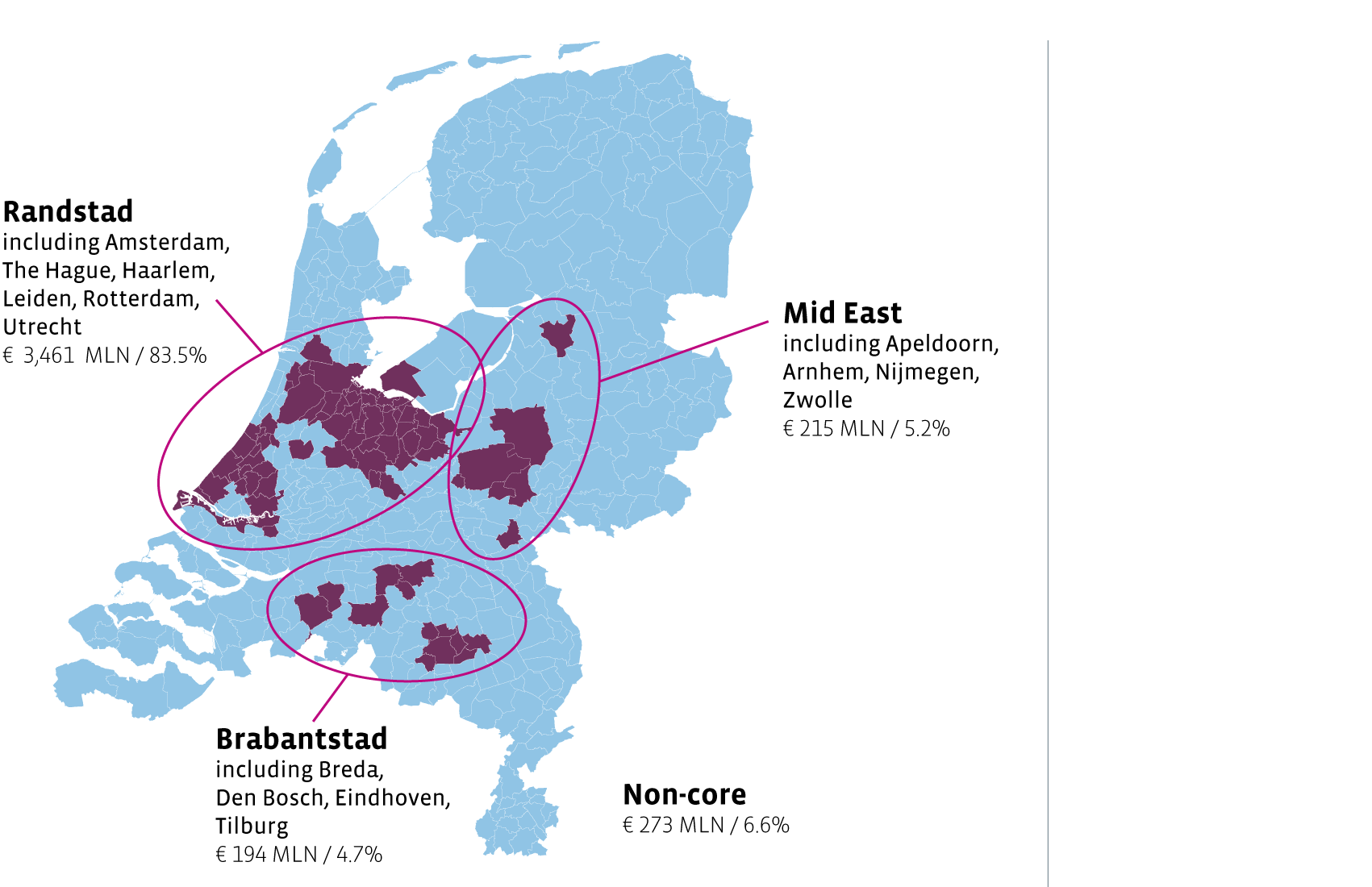

Core region policy

To identify the most attractive municipalities for residential investments, the Fund considers the indicators:

The target is for at least 80% of the total portfolio value to be in investment properties in the Fund's core regions. This currently stands at 93.4%.

The Residential Fund's core regions based on market value excl. property under construction

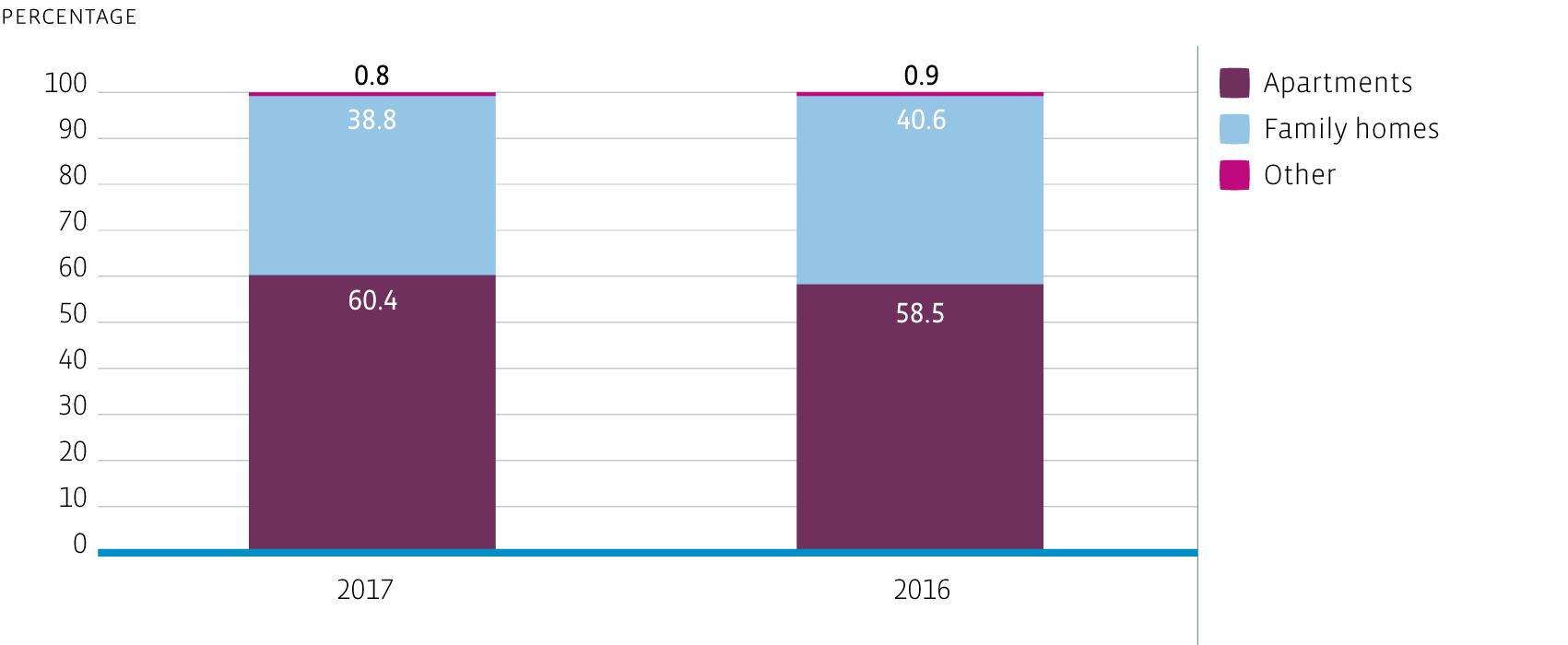

Major segments

To meet its own diversification guidelines, the Fund strives for a healthy balance of family homes and apartments. Because we focus on urban areas, the proportion of apartments will continue to grow for the foreseeable future. In 2018, we will expand the diversification guidelines. One of these guidelines is that a minimum of 25% of the portfolio must consist of family homes.

Portfolio composition by type of property based on market value

When we are optimising our portfolio, we take into account the following diversification categories:

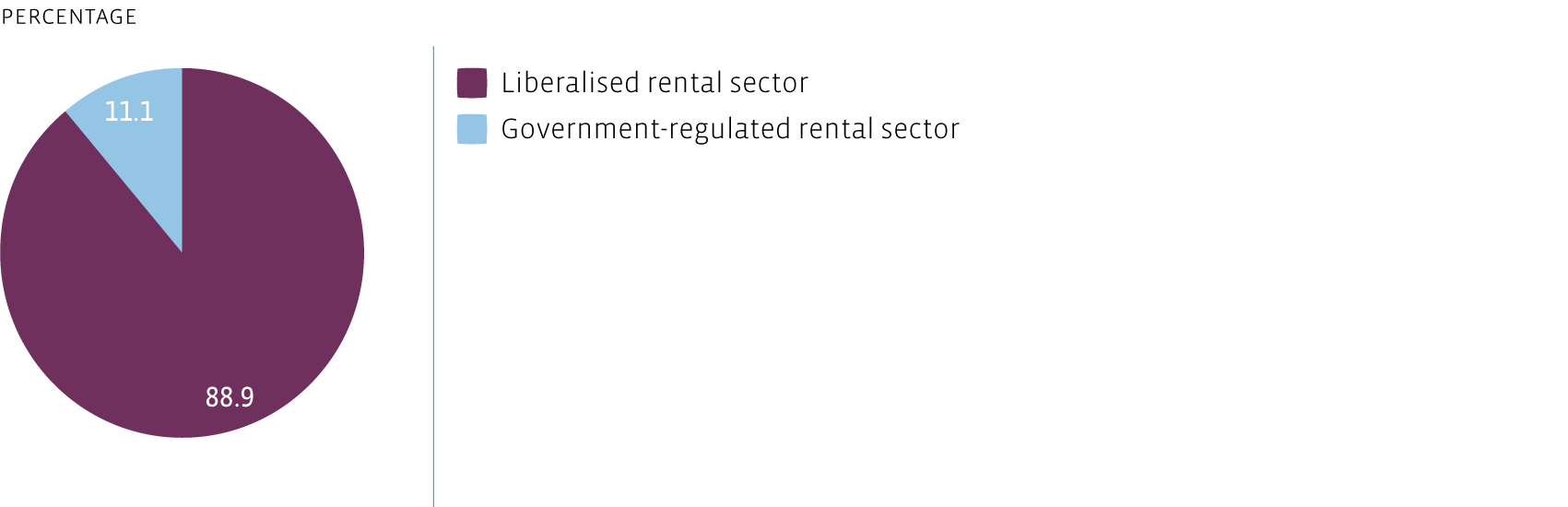

Focus on liberalised rental sector

With an average monthly rent of € 1,020, the focus of the Fund continues to be on the mid-rental segment

(€ 711 - € 1,250). The liberalised sector (rents of € 711 and above) is particularly interesting for the Fund, as demand is growing and supply is lagging, especially in the Netherlands’ largest and most popular cities. Furthermore, demand is growing as a result of the recent sharp price increases in the owner-occupier market. To keep providing housing opportunities for mid-income households, more and more local governments are introducing new policies to encourage the construction of affordable housing. Nevertheless, the liberalised rental sector, with its high occupancy levels, remains an attractive market for institutional investors.

Portfolio composition by type of rent based on rental income

Selection of principal properties

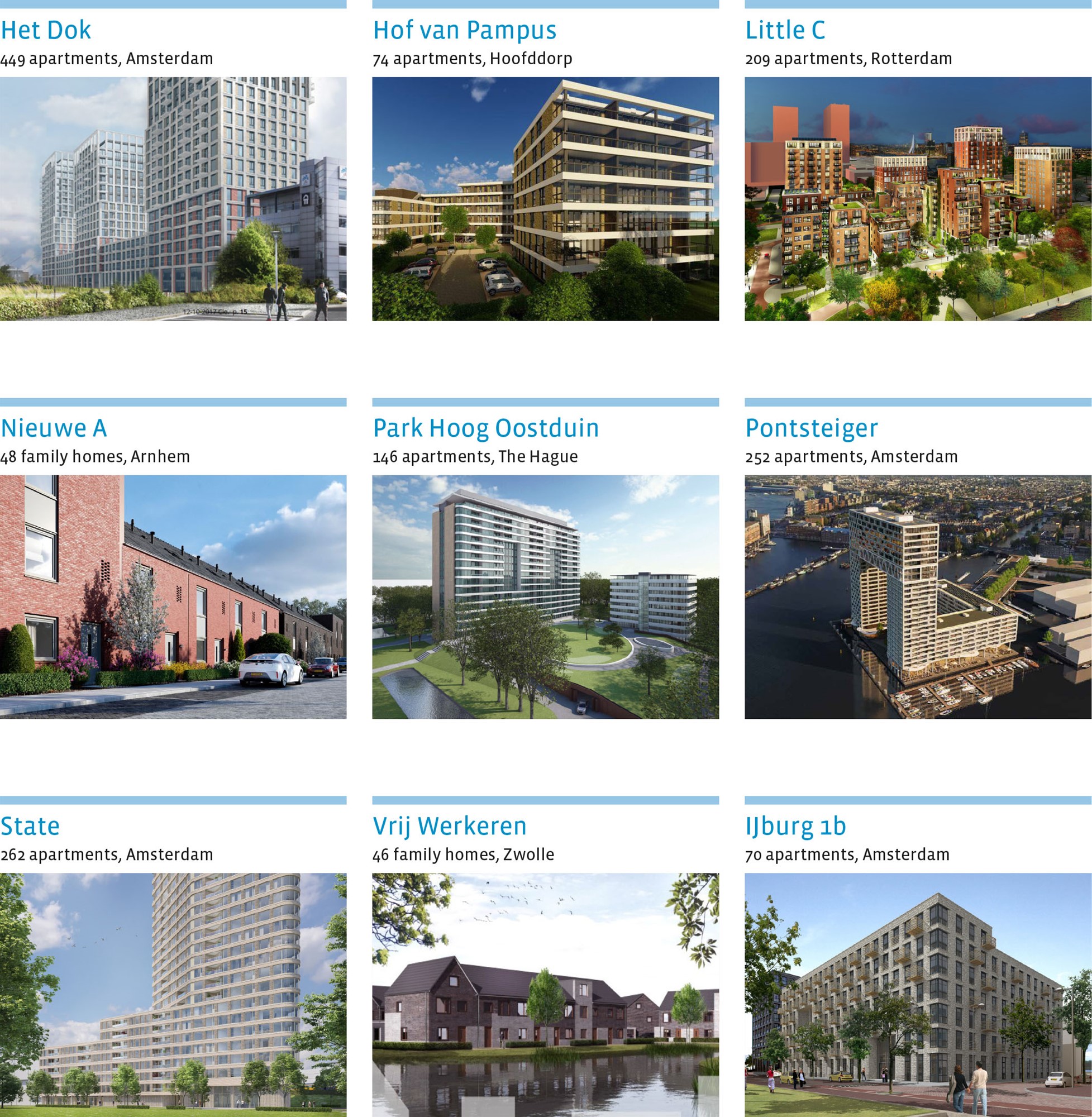

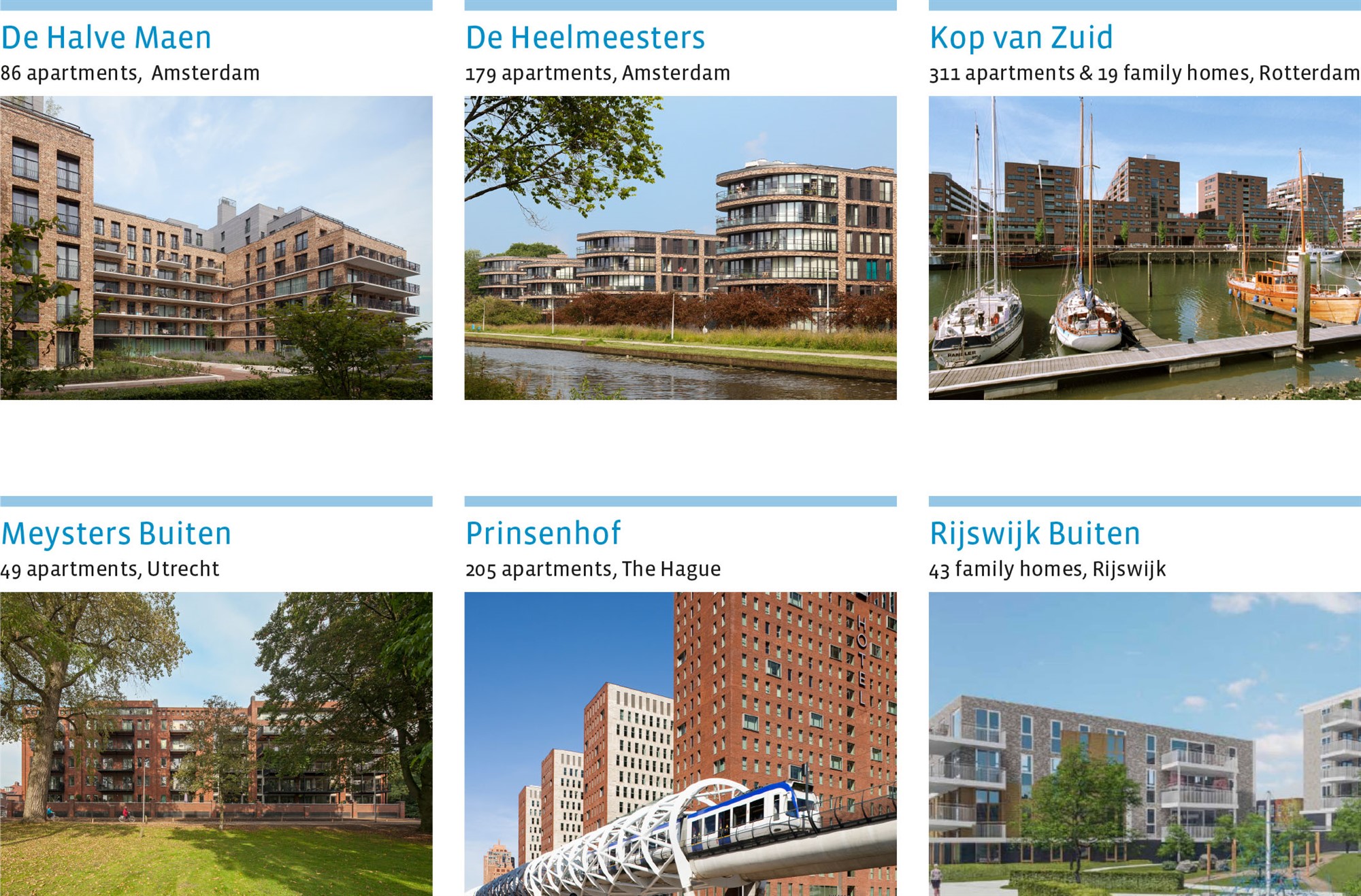

Existing portfolio (selection)

Added to the portfolio (selection)

Portfolio pipeline (selection)